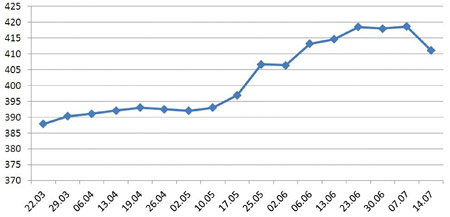

If nothing noteworthy happens in the economy of Armenia, the foreign currency fluctuations will be a permanent topic of discussions in media. After a rapid growth, in the end of the week the national currency started falling down.

Since July 9 the average rate of USD (according to the CB) has fallen down from 418.64 to 411 drams. If this process continues, in two weeks the exchange rate will fall down to the level before the elections – 391 drams. It is difficult to figure out what the reason of these fluctuations is. The main factor discussed for inflation of the national currency was elections. The capacity of cash flow out of the Central Bank was significantly increased, resulting in inflation of the national currency. During the period of May 4 – June 20 the price of US dollar rapidly grew from 391 to 420 drams. With some minor fluctuations the exchange rate continued to be around the mentioned limits till July 7. One of the reasons of inflation of the national currency was also named the fact that the president of Armenia said several months before that the national currency would be under inflation, the process of which had to be slow and without any rapid fluctuations not to hit local producers and exporters. By the way, the impression is that the CB is not able to control the situation and the exchange rate may ruin one day. Even Vartan Oskanyan has tackled this issue of foreign currency exchange rate and its impact on covering the country foreign debt. However, the appreciation of the currency was not expected and people started to view this process as a part of the global tendency. For example, ARF faction representative Artsvik Minasyan says that the fluctuations of currencies in the international market are affecting the Armenian market as well. He focused on two factors influencing on the currency in the market, one of which is the fact of being an importer country, and the other is the monetary policy. “Armenia is an importer country and any fluctuations of exchange rates influences on the decisions of importers, which results in either big demand or supply. This is the reason why the exchange rates are fluctuating so rapidly in Armenia,” said Minasyan. There is another factor as well, which is the fact that in the country the capacity of the money pool in the national currency has been reduced, which resulted in growth of dollar. The MP says that it depends on the government’s policy and the behavior of large importers. In difference with Minasyan’s opinion, ANC member Hrant Bagratyan thinks this is not a fluctuation but inflation of the national currency. In May Bagratyan predicted stabile inflation of the national currency, and there would be not rapid changes as the inflow of money transfers was growing. Bagratyan believes the exchange rates changed because the payment balance of the country is bad and we pay more in dollars than we receive, and “the capital is flowing out of the country.” “Also the electoral bribe had a great impact as a lot of money has been given to voters and in that period the Central Bank increased the emission. Ultimately there is no growth in the economy, there is no real export, even though there is some fluctuating export,” said the former prime-minister.

These several days were non-working days. The stock exchange will start working today and we will see the future processes happening to the exchange rates market. In the period before this there was a rather active trade of foreign currency going on. According to the information of the CB, in July 1-14 banks bought USD186,198,564 at an average rate of 415.78 for a dollar. In total USD205,002,517 was sold at an average rate of 417.25 drams. In the mentioned period USD27,850,000 was traded in NASDAQ OEMEX market at an average rate of 414.72 drams for one dollar. By the way, the official statistics also reveals changes in the crediting conditions as a result of currency exchange rates fluctuations. During June 25 – July 8 (when the exchange rate was around 418 drams) banks issued credits amounting 51.9 billion drams (around 125mln dollars), and credits in dollars amounting 79.3 million. In fact the average capacity of credits in drams on a weekly basis was USD62.5 million, which is less than in May (70 mln weekly). This shows that trade banks have started to give preference to credits in US dollar. In this condition ordinary citizens are undecided, who do not know which currency is better for keeping their savings.