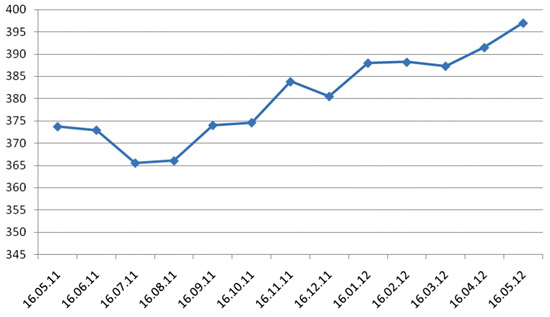

After rapid growth during the past days eventually this process stopped for a while. Yesterday in NASDAQ OEMEX Armenia stock exchange the average exchange rate of US dollar was 396.99 drams. This is higher by 0.147% (0.54 points) than the rate on May 15. This means that the rapid growth of the exchange rate has been resisted at least temporarily. It will be possible to find out how it happened and who did it in several days. Generally 61 transactions were done, as a result of which 8,550k dollars was sold. As the process was stopped unexpectedly, we may assume that this was due to the investment of the Central Bank. We will see that clearly on Monday, when the CB publishes information about financial transactions.

Currency exchange offices are buying dollar minimum at 395 drams and selling at 398.5-399 drams. We are almost at the psychological limit of 400 drams.

During the past week the topic of the exchange rate has been on the top of economic news headlines. The biggest question is how this growth can be explained. According to the official statistics, the inflow of money transfers from abroad continues to arrive, thus this growth of exchange rates is not connected with it. Import is growing too. This means that the inflow of currency has not stopped. Thus, the only and most logical explanation is connected with elections. In other words, during the pre-election period huge amounts of dollar have been exchanged to drams for giving electoral bribes, and now this extra capacity of drams in the economy pushes the dollar up. This point is also proven by the CB’s statistics, according to which during April the capacity of cash drams out of the Central Bank has increased by 35 billion. In answer to the question of Radio Liberty concerning the depreciation of the national currency the Central Bank gave the following answer: “Armenia has adopted a policy of floating rates, which means that the exchange rates may change under the influence of different market conditions. Changes in the demand and supply of it may result in short-term growth or fall of the exchange rate.”

In fact nobody can answer to the question how long this process may continue and whether it will stop or no. The Central Bank has tools that can be used for this purpose. In consideration of the fact that during the previous week the CB had sold 6.5 million dollars, but the rate of dram continued going up, experts said that the situation was out of the Central Bank’s control. However, yesterday’s situation shows that the CB can control the situation.

It is important to know whether this growth of the exchange rate is good or bad for the economy. In school books it is written that long-term inflation of the national currency is good for domestic producers and exporters. However, this may be helpful when this process goes slowly, slightly and in stabile conditions. However, this growth of the exchange rate, especially that happened after the election, is a serious fluctuation and change in the financial market.

In addition to these changes, the inflation of the national currency will result in growth of prices as well. In Armenia’s GDP import has a great share, thus the exchange rate changes will result in the growth of not only imported products, but domestic production as well. By the way, a number of products have become more expensive already (for example, some types of exported cigarettes). People are joking that by increasing the prices of products the businessmen and MPs want to bring their money back after having them spent in elections. If that is the case, they can refer to the currency exchange rates to justify the increase of prices.

There is another sector of the society, which is not interested in the growth of foreign currency exchange rates, especially rapid growth. This group consists of the people that have bank deposits in the national currency. They simply lose money in this process. During one year the national currency has slumped by 6%. If we add the inflation rate of 4-5% to this, the only thing investors in deposits can hope for is not to lose more as a result of changes in the exchange rate dynamics. In other words, deposits in the national currency are risky, which is the reason why many people were in panic as they were afraid that the exchange rate would grow even more.

In this entire process the trade banks may benefit. By implementing an aggressive policy of commercials for recruiting deposits in the national currency, banks have significantly increased the capacity of deposits in the national currency. Meanwhile, when issuing credits, banks preferred to offer credits in foreign currency (especially US dollar).

According to the information of the official statistics, in the end of March of this year the capacity of deposits in the national currency covered 30.8% of the entire capacity of deposits, in case when in March of the previous year this capacity was 28.9%. This means that in banks the capacity of deposits in the national currency has been growing. In contrast, the amount of credits issued in US dollar has been increased. During the previous year the credits issued in the national currency covered 39.04% of the entire capacity, but in the end of March of this year this amount went down to 36.46%.

In a word, banks have borrowed money in the national currency and lent in dollars. They offered higher interest rates for the drams they borrowed, but this difference was fully compensated on the account of inflation. We would advise all people who are investing money in credits not to put all their eggs in one basket, especially when this basket is Armenian.