All the 1000 major taxpayers of Armenia have jointly paid 318.5 billion AMD worth of tax for the period of the first 9 months of this year. This amounts to over 72% of the total tax collected in Armenia. In January-September of 2010 the state budget of Armenia had received 441.1 billion AMD tax and custom payments.

The specialists and journalists are always trying to find the answer to the following question when reviewing the list of the greatest taxpayers. On whose shoulders is the tax burden – the large or small businesses? Let us mention that during the same period of the previous year the tax inflows have grown by 18.9%. The tax body had exceeded its 9-month plan by 9.2%. Taking into account that fact that during the same period the economy has grown only by 92.8% we may assume that everybody had felt the weight of the tax burden. Yesterday several online agencies have tried to draw certain comparisons. The tax inflows have grown by 18.9% and the taxes of the top 1000 taxpayers by 17.7%. We may assume that the small businesses have paid a little less this time. But this is not for sure. For example the first 100 taxpayers have jointly paid to the budget 19.3% more than in the previous January-February. And the top 50 companies have increased their payments by 20.6%. The society is interested in the tax list to find out information about certain companies. According to the list released by the State Revenue Committee of Armenia the top taxpayer is ArmRusGazArd, which during the first 9 months of the year had paid 12.9 billion tax (approximately 35.8 million USD). The second place occupies Alex Grig, which has paid 12 billion 590 million AMD tax. But if we observe the list based on the owners of the companies we turn out to have a very interesting picture.

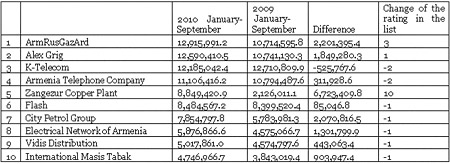

The taxes of the top ten companies in thousand AMD

Thus, Alex Grig belongs to NA MP Samvel Alexanyan. However besides the Alex Grig Alexanyan also owns other large tax paying companies – Natali Pharm, Lusastgh Sugar (which is in charge of sugar production) and other companies. Natali Pharm occupies the 355th place on the list of the biggest taxpayers, which during the reporting period had paid 1 billion 366 million AMD tax and Lusastgh Sugar, which rates the 153rd place paid 336.8 million AMD. We can calculate that these three companies have jointly paid 14.3 billion AMD worth of tax. And it turns out that the biggest tax payer of Armenia is Samvel Alexanyan. By the way, in the list there are no major changes compared to the previous year. The super big companies have mostly maintained their ratings or have shifted by 1,2 or 3 ranks. The only perceptible exception is the rank of the one-time greatest taxpayer – Zangezur Molybdenum Plant. During the previous crisis year this company according to the results of the third quarter among the biggest tax payers this company had yielded 15 ranks by paying 2.1 billion AMD tax. This year Zangezur had increased its payments for over 4 times and increased its rank by 8.8 reaching the place on the list. This mainly happened due to the drastic increase of the world price of copper and molybdenum. In the top 10 besides Zangezur, ArmRusGasArd (by three ranks) and Alex Grig (by one rank) have also shifted up.

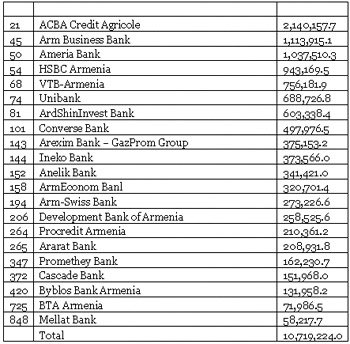

The banking statistics of the Armenian banks is also quite interesting

All the Armenian banks during the first 9 months of this year have totally paid 10.7 billion tax. However, the none-proportionality between the banks that lead the list and are at the bottom is quite noticeable. The difference is 36 times. Thus, the greatest taxpayer among them is the ACBA Credit Agricole, which had paid 2.1 billion tax and occupies the 21st place on the list. And Mellat Bank during the reported period paid only 58 million tax and rated on 848th place on the list.