Journalists are impatiently waiting for the publication of the quarterly report on the biggest taxpayers of Armenia. There can always be reasons to criticize the tax bodies and the government. Unfortunately the list of the biggest taxpayers discovers the most vulnerable points of the tax collection system as the heavy load is still born by small and medium businesses.

What are journalists trying to do? We take the report and compare it with the report of the previous year to see the changes. And if we find out that the overall tax collection from the 300 biggest taxpayers has increased more than the taxes levied on the first 100 biggest taxpayers, we come to the conclusion that the tax load is more born by small and medium businesses. To be honest, after the prime minister criticized the tax collection department, we thought the list would contain the same information, but this time the situation is different.

According to the statement of the ministry of finance, during the first quarter of 2010 the state duties and taxes paid to the budget amounted 127.1 billion dram. Compared to the same period in 2009 the mentioned budget inflow grew by 19.2% (20.5 billion dram). We will compare this information with the tax payments on part of the biggest taxpayers. According to the information of the state income committee, in the period of January-March 2010 the biggest 1000 taxpayers of Armenia paid 97.4 billion dram tax to the state budget. This amount was 74.1 billion in the same period of the previous year. Accordingly, the capacity of tax payments on part of the biggest taxpayers grew by 31%. In consideration of the fact that the economic growth of the mentioned period was 5.5%, this amount of tax collection is rather big compared to the previous reporting period.

However there is a negative thing in this fact: the capacity of direct taxes paid by this company is small (25%).

However, generally the capacity of direct taxes (paid by all the taxpayers) is big. Specifically, in the first quarter of this year 14.8% of the budget payments were formed from profit tax (18.8 billion dram). In the same period the income tax amounted to 16.2 billion dram (12.8% of taxes and state duties). In other words, in the entire economy the capacity of direct taxes – income tax and profit tax – was 27.6% instead of the 22.8% the biggest taxpayers paid.

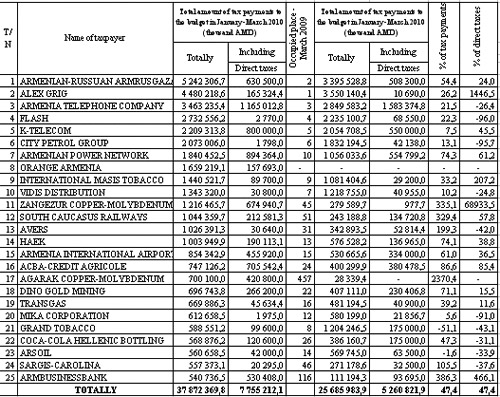

Generally in the entire economy the half of tax incomes was paid as value added tax. It means that the real taxpayer is not the business, but the final consumer as this VAT is included in the final price of products. There are interesting things concerning direct taxes in the list of the biggest taxpayers. The chart in this section is made based on the information for the first quarters of this year and the previous one. It clearly shows that most of the companies have increased the tax payment capacities, but the capacity of direct taxes has decreased. For example, in the first quarter Armentel company paid more taxes by 21.5%, but the capacity of direct taxes decreased by 26.4%. Flash company paid more taxes by 22.3% but the capacity of direct taxes fell down by 25 times. Mika Corporation shows that it has paid more taxes by 5.1% but the capacity of direct taxes is less by 10 times. Unfortunately this list does not contain information on separate direct or indirect taxes, but logically it means that the reduction in taxes is a result of reduction of profitability. It means that the crisis still continues. But there are companies, which paid more direct taxes. One of these examples is Samvel Alexanyan’s Alex-Grig company, which is in the second place in the list of the biggest taxpayers. This company paid more taxes by 26.2% in the first quarter of this year, and it paid 15 times more direct taxes. While last year this company paid 10.6 million dram, this year it paid 165 million direct taxes. The following companies increased the capacity of direct taxes: International Masis Tobacco (107.2%), ArmBusinessBank (366.1%), Ameriabank (143.2%), Hrazdan HPCC (25 times), Zangezur copper-molybdenum company. The mining sector companies were affected by the crisis most, which resulted in tax payment reduction on part of the mining sector. Zangezur copper-molybdenum company is in the 45th place (279.5 million dram) this year, while it used to be in the first place. This year the company is reviving and is in the 11th place and has paid 3 times more taxes. As for the direct taxes, the capacity of direct taxes grew by 690 times. In this quarter the company paid around 675 million direct taxes to the budget, while in the same period of the previous year it paid 997 thousand.

In a word, the list of taxpayers shows that the economy has started recovering as the numbers are growing. But indeed the growing numbers are still under the shadow of the biggest malformation of the economic system. The list of the biggest taxpayers consists of only importing and mining companies. By the way, most of the half of these companies do not belong to Armenian companies.