While the economic officials of Armenia are not losing a chance to brag about our banking system the data of the RA Central Bank witness of the opposite picture.

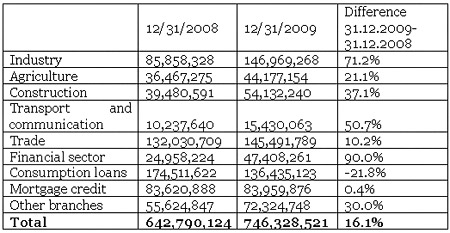

The most important datum is that the 22 commercial banks operating in the territory of Armenia with their 391 branches received three times less profit in 2009 than last year. According to the Overview of the commercial banks operating in the territory of Armenia as of December 31, 2009 the net profit of banks after taxation amounted to 8 billion 576 million AMD. This is 68% less from the same index of 2008, when the profit was 26 billion 868 million AMD. Moreover, in the USD equilibrium the profit is bigger by 4 times because at the end of 2008 one USD was worth 305 AMD and at the end of 2009 the USD rate was 377 AMD. It turns out that in 2009 the profit of banks amounted to 22 million USD compared to 88 million of the last year. The amount of the loans given to legal entities as of December 31, 2009 is 395.9 billion AMD, which is higher compared to the last year’s figure by 36.7%. Instead the loans given to physical entities lowered by over 7% – reaching 285.9 billion AMD from 308.3 billion. Moreover, the volume of consumption credits reduced by 21.8%. We have numerously spoken about the restriction of the conditions of registration of crediting. Before the economic crisis, the commercial banks would allow to prolong the credit line. For example, if the consumer bought a refrigerator by loan then after paying off the amount he/she could easily continue the credit line by buying a television set without additional documentation. Presently there is no such opportunity. It is necessary to produce all kinds of affidavit forms from workplace and residence and a bunch of other structures. Besides that, certain banks refuse to give consumption credits to customers with AMD. Instead they are offering the so-called credit cards. It is the same thing as to take a loan with just one difference that the credit is in USD. Thus, perhaps the banking system of Armenia maintained its stability in the crisis conditions but it has become not unaffordable for an essential number of average citizens. As the table shows, during the last year the banking system has been most “generous” to the industry sector. Here a 71.2% growth was registered. As a result the obligations of the industry sector compared to the banking system of the end of the last year reached 150 billion by occupying the first place with its volume. Before that the first place was occupied by the trade sector, the total volume of credits given to which, amounted to 145.4 billion AMD. The table also shows that the amount of the mortgage loan remained almost unchanged. During the last year it grew by only 339 million AMD or 0.4%. Let us also mention the index of the positive growth (even small) doesn’t mean much. Unlike the consumption credits, the acquittal period of the debt is quite long and the size of the portfolio cannot decrease. And the cut of the crediting volumes is indeed stipulated by the global crisis, as a result of which the conditions of crediting were restricted and the real estate market appeared in the swamp. According to the data of the Real Estate Cadastre adjacent to the RA government, the number (154.462 units) of the real estate transactions in 2009 reduced by 3.1% (4905 unit) compared to 2008 – in Yerevan by 6.0% (3370 unit) and in marzes by 1.5% (1535 unit). By wrapping up the banking system theme let us mention the banking indexes in the tax line. According to the data of the State Revenue Committee 16 banks and 3 credit organizations were included in the list of 300 largest taxpayers of Armenia in 2009. According to this data ACBA Credit Agricole Bank occupies the 17th place in the mentioned list by totally paying 2 billion 339 million AMD worth of taxes. The mentioned bank is followed by ARDSHININVEST Bank (19th place in the taxpayers’ list), which paid 2.3 billion AMD worth of taxes. The next are VTB Armenia Bank (2.2 billion), HSBC Armenia (2 billion 43 million), Unibank (1.4 billion) and others. In the list of the greatest taxpayers the Procredit Armenia occupies the 287th place with 246 billion AMD worth of taxes.

Credits, deposits given to residents by commercial banks, factoring, leasing according to branches , thousand AMD