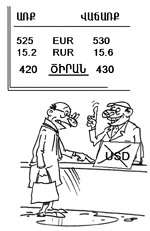

The dollar continues going “up one and down two” while citizens of Armenia keep talking about the dollar-dram exchange rates.

After parliamentarians offended head of the Central Bank Tigran Sargsyan at the National Assembly, the “floating” dollar stopped going down for a moment, went up a little, and after seeing that Tigran Sargsyan can get himself out of the situation rather well, continued going all the way down.

Head of the Central Bank is not freeing himself of the accusations, but rather he is advertising Armenian economy when he says that he is going up…. He reminds us:

“If you took the Central Bank’s advice and kept savings in drams, you would have gained 30% more in the past 2-3 years.”

Who exactly keeps savings and for what purpose? Answer: The people saving money have a lot of money and take in more than they spend. The average salary in Armenia is 52,000 AMD (125 dollars) and it’s not even enough to earn a normal living. You need to have other jobs in order to invest in the bank. People prefer getting paid in other currencies and it’s obvious that their savings are either in dollars or euros.

If we exclude the “giving money for interest rates” variant, (this is more of a non-business investment), we’re left with the following: money “in case”, money to buy something expensive or to travel. You don’t need to exchange the dollar into drams for that.

Let’s say an oligarch has a 10 million dollar savings or a sum of money for his personal needs. Let’s think: what can he spend that money on?-a new “Hummer”, a villa abroad, the latest technological advances, 10-day vacation in Hawaii…So, when will he need the “big” dram? Will he buy a “Hummer” with the Armenian dram? Is he going to whip out a 5 or 10 thousand dram to pay for a cocktail at an exotic café on the coast of the Pacific Ocean, or is he going to travel around Las Vegas with drams? Only foreigners collecting currencies are interested in the Armenian dram. I can explain to many people that there is a land called Armenia where the “dram” currency “wins” the dollar. But this won’t impress anyone, if of course that person isn’t a representative of the International Monetary Fund. But seriously, the only people keeping savings are the rich, who save their money in dollars or euros and prefer keeping the savings in countries that haven’t even heard of Armenia. No, perhaps they’ve heard of Armenian apricots. Question: what do apricots have to do with this? It’s better to ask MP and economist Grigor Ghonjeyan. On June 21, during an interview on “Shant” television, he was asked just how the worker at the “exchange rate point” buys the dollar for 430 drams in the morning and decides to fix it at 420 two hours later. In response to this, he said that the price for apricots is different in the morning and the afternoon.

According to the MP and economist, this fruit plays the same role as the dollar. It’s obvious that Mr. Ghonjeyan meant that the price of the dollar is determined based on the apricot and the free market principles. But what’s interesting is that foreign countries know more about this type of fruit than the “strong” dram. Perhaps the CB can fix the apricot as a currency, take control of growing the apricots and selling them. Does it sound that daring? What can we do? At least we’ll remember that the CB is helping the country each time we eat an apricot. The gardener and the janitor will both have jobs and the MPs wishing to get another job will have many outlooks. The only thing left to do is decide how to fit the “spiral” in the apricot, but that has to do with techniques.